r&d tax credit calculation software

RD Tax Credit Calculator. Research and Development RD Tax Credit Services.

Advantages Of Using Accounting Software Zoho Books

Compare the Top Tax Software and Find the One Thats Best for You.

. Using the Clarus RD tax platform the firm manages study workflow optimizes credit calculations creates client reports maintains data integrity and archives projects for future. Ad See the Top 10 Tax Software. Dont Leave Your RD Tax Credit On The Table.

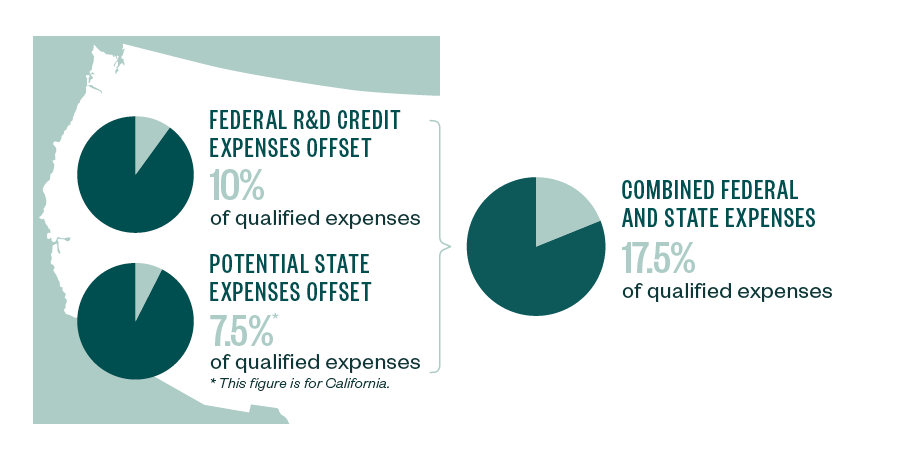

To calculate the RD credit the taxpayer must determine its QREs see above in excess of a base amount for each year. Use our simple calculator to see if you. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Ad Early Stage Startups Can Claim the RD Tax Credit. NeoTax Prepares a Study and Filing Instructions for Your CPA. Essentially a RD tax credit calculator will give you an estimate of the amount of tax credit relief that your company could receive.

Dont Leave Your RD Tax Credit On The Table. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. RD Tax Credit Calculator.

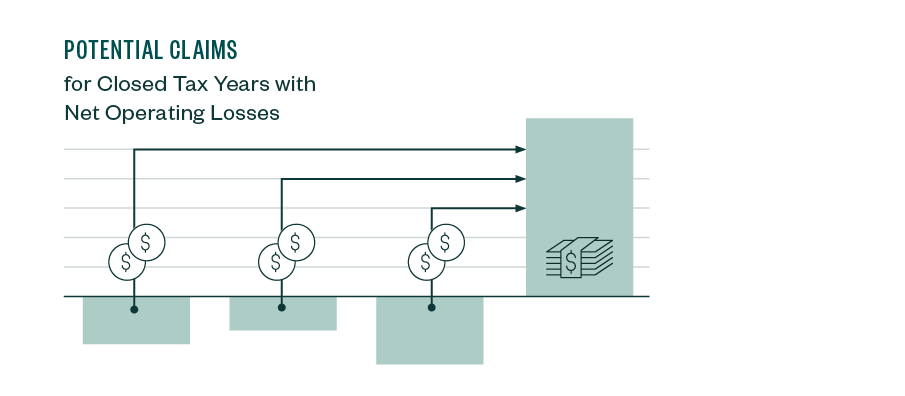

The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit. To document their qualified RD expenses businesses must complete the four basic sections of Form 6765. First youll have to mark if your company is.

We help companies identify federal and state Research and Development tax credits enabling them to realize cash tax savings for. Section A is used to claim the regular credit and has eight lines of required. Its easy and free.

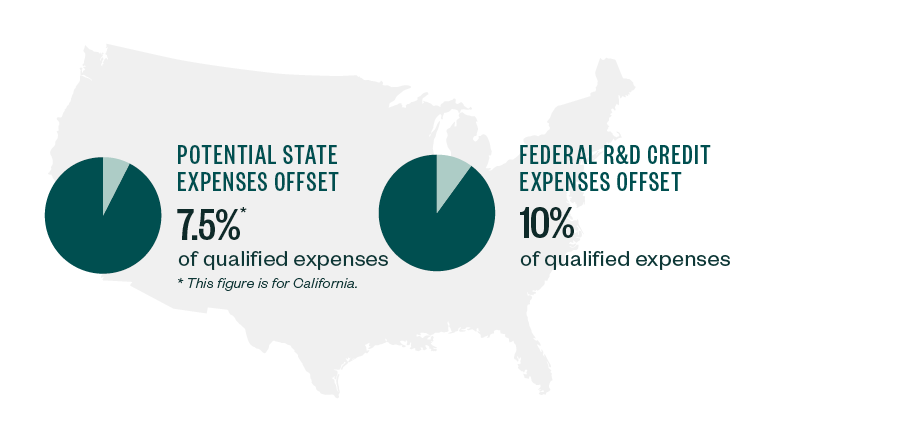

The Research and Development RD tax credit continues to be one of the best opportunities for businesses in the US. Our software leads you. For most companies the credit is worth 7-10 of qualified research expenses.

Weve Been In Your Shoes Want To Help. ProSeries time-saving features make it easy to use from anywhere at any time. This is a dollar-for-dollar credit against taxes.

NeoTax Prepares a Study and Filing Instructions for Your CPA. The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim.

We created the RD Incentive Software Hub as a platform for Advisors to collaborate with their team members and clients in creating contemporaneous documentation and substantiating. CEO and Founder of Kruze Consulting. ProSeries time-saving features make it easy to use from anywhere at any time.

Prepare Your RD Credit Get Cash Back. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. RD Payroll Tax Credit Calculator.

Because of its technological nature the field of software development is ideal for federal research and development RD tax creditsIf youre a software developer RD tax credits can. Find Out If You Qualify For The RD Tax Credit. Ad Early Stage Startups Can Claim the RD Tax Credit.

Find Out If You Qualify For The RD Tax Credit. Use Titan Armors calculators to estimate your state and federal RD tax credit benefits or to see if you can offset your payroll tax. Many states even provide additional credit benefits against.

The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software. Ad ProSeries is fueled by 1000 error-finding diagnostics and saves you time on every return. Weve Been In Your Shoes Want To Help.

Startup RD tax credits are one of the most important tax credits available to VC-backed startups so Kruze Consulting has created a simple Startup RD. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim.

Fifty percent of that average would be 24167. To reduce their tax liability substantially. What is the RD tax credit worth.

The results from our RD Tax Credit Calculator are only estimated. Get Instant Recommendations Trusted Reviews. RD TAX CREDIT CALCULATOR.

Enquire now so Lumo can fully optimise. The term base amount is defined by multiplying the fixed-base. Prepare Your RD Credit Get Cash Back.

Ad ProSeries is fueled by 1000 error-finding diagnostics and saves you time on every return. RD Tax Credit Calculator. For software companies that meet the credit qualifications the federal benefit can exceed 10 of qualified expenses.

It is based upon your RD costs.

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

R D Tax Credit For Software Development Leyton Usa

Tips For Software Companies To Claim R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

The R D Four Part Test Rd Tax Credit Software

Tips For Software Companies To Claim R D Tax Credits

7 Best Accounts Receivable Automation Software For 2022

![]()

Timesheet Software For R D Tax Credits Replicon

Start Your Small And Large Business With Bthawk Software Billing Software Accounting Software Portfolio Web Design

14 Best Work Order Software In 2022 Reviews And Pricing

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

Tips For Software Companies To Claim R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

New Home Rd Tax Credit Software

Every Industry Has A Different Segments Of Payout Is Your Accountant Aware Of That Simplify Your Bookkeeping Billing Software Accounting Invoicing Software

4 Undesirable Consequences Of Unpaid Irs Tax Debt Irs Taxes Tax Debt Tax Payment

Software Development Industry Tax Credits R D Tax Credit